Businesses have a wide array of expenses. Paying their bills on time, investing in their business growth, and even delivering employees' salaries on time can be difficult for businesses that rely heavily on customer invoicing to meet their financial obligations on time. An accounts receivable factoring company may be able to help businesses protect their cash flow and working capital with a financing solution known as invoice factoring.

What Is Invoice Factoring and How Does It Work?

Also known as accounts receivable factoring or just factoring, this type of funding solution is not a traditional business loan. Instead, the business in need of funding sells its accounts receivable invoices or specific invoices to a factoring company. The factoring company then pays the business most of the value of the invoice amounts, with a percentage retained as factoring costs. The business can use the funds as it needs without having to wait for customers to pay their invoices.

Factoring firms will then collect the invoice payments from customers. They will retain the invoice amounts they advanced to the business plus their factoring fees according to the factoring agreement. They will also return any of the outstanding balance owed to the business from the factored invoices. Invoice factoring has become a popular alternative funding solution for businesses in many types of industries, particularly those that rely heavily on customer invoicing.

Are Factoring Companies Legitimate?

Yes! Accounts receivable financing is a legitimate form of business financing, and there are many reputable business financing companies that offer this type of funding solution. The factoring industry supports both small and mid-sized businesses who may not want (or do not qualify for) a traditional loan because of its short credit history or business history.

An accounts receivable factoring company that supplies accounts receivable financing simply provides an alternative to conventional bank loans and other forms of business financing. It should be noted, however, that not all factoring companies will provide the same value and level of service. Most factoring companies provide financing based on the value of the accounts receivable, but there is significant variation in the market, so it is important to weigh your options carefully.

What Are the Benefits of Accounts Receivable Factoring?

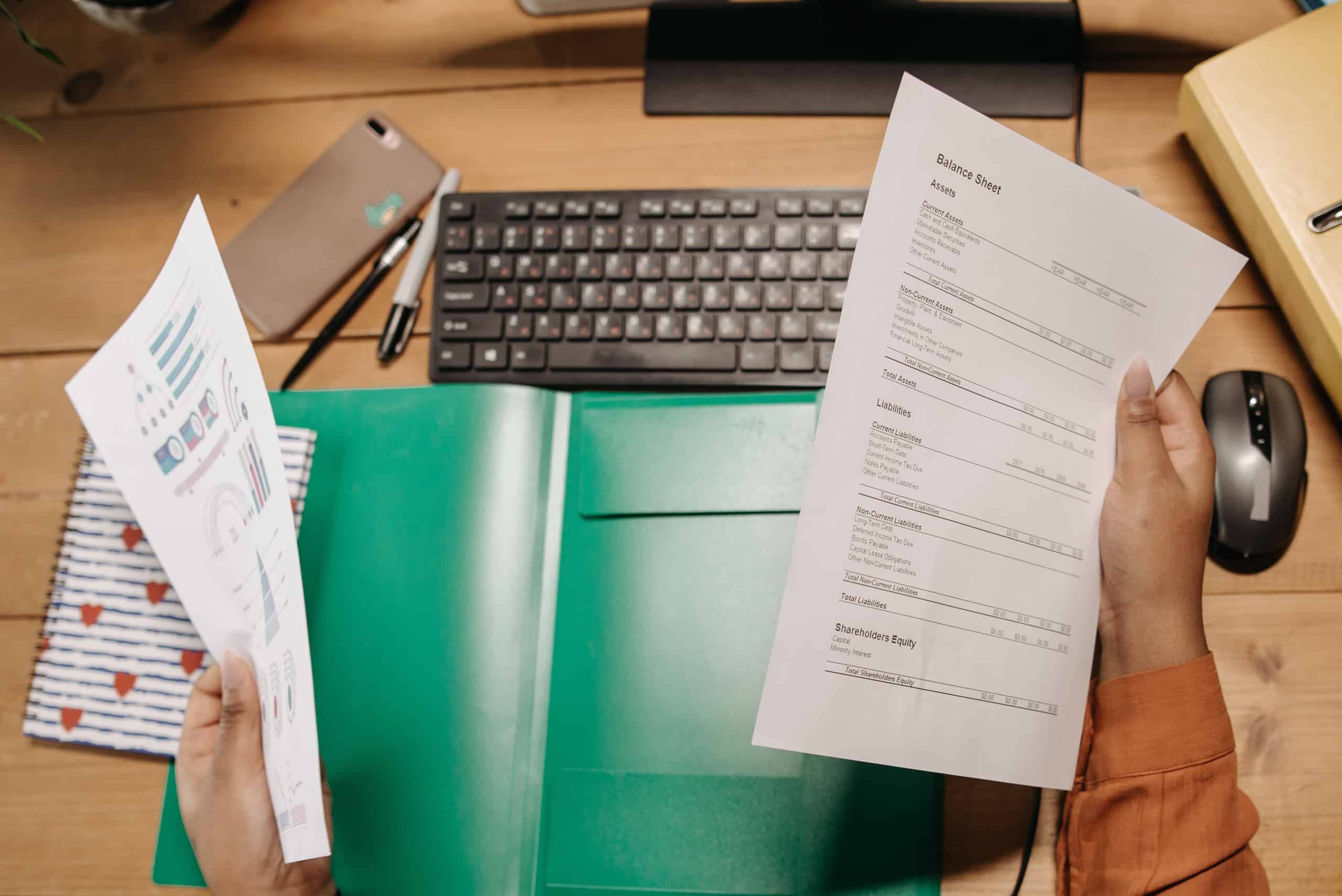

Many businesses choose accounts receivable factoring to help them when they’re facing a challenging financial situation or need to expedite access to their accounts payable for working capital. A business’s accounts receivable invoices are an asset; factoring companies buy these assets based on invoice amount and supply businesses with cash advances based on the outstanding invoice amounts. While the financing company has the ability to wait for the invoices to be paid, a business in need of working capital might find it challenging to wait for their customers to pay their outstanding invoices.

When a business owner receives the cash advance, it can use the funds to grow its business, invest in business opportunities, or meet its financial obligations without sacrificing its cash flow. Like a line of credit, invoice factoring affords businesses with the cash advance from unpaid invoices minus a small fee.

Simplify Your Access to Capital With Accord Financial

If your business is weighing the costs and benefits of working with accounts receivable factoring companies, choose Accord Financial for our versatile business financing solutions. We can help you free up the cash flow you need to reach your goals.